When it comes to owning a car, one of the most crucial yet often overlooked expenses is car insurance. Whether you’re a new driver or someone who’s looking to save on their current policy, finding cheap car insurance in the USA is a common goal. In this comprehensive guide, we will walk you through everything you need to know about securing the best deal without sacrificing coverage.

For most drivers, car insurance is an essential and recurring expense that cannot be avoided. Yet, many car owners are often unaware of how they can reduce their premiums without compromising on essential coverage. Whether you’re in the market for your first car insurance policy or looking for ways to save on your current one, this guide will help you navigate the process, compare prices, and find affordable car insurance that meets your needs.

What Does “Cheap Car Insurance” Really Mean?

The phrase “cheap car insurance” might initially seem like a bargain, but it’s important to understand what it really means. Cheap car insurance doesn’t mean compromising on quality. It refers to finding a policy that fits your budget while providing the protection you need. There are several factors that affect the cost of car insurance, and understanding these elements is the first step in finding the best rates.

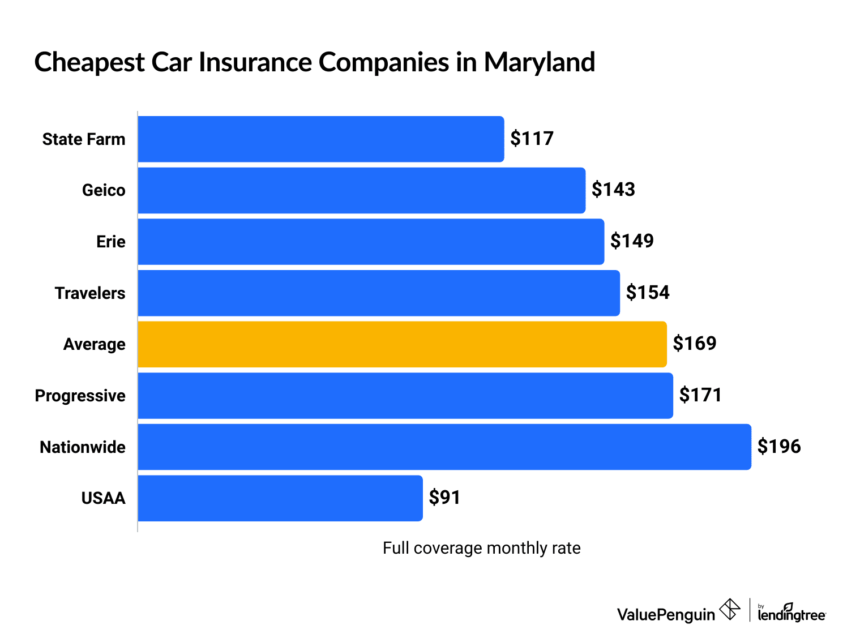

Cheap car insurance can vary significantly from state to state due to different local regulations, insurance laws, and the nature of the driving conditions. Additionally, insurers consider several key factors when determining your premium, such as your driving history, age, and the type of car you drive.

Understanding How Car Insurance Works

Before jumping into finding cheap car insurance, it’s important to understand how car insurance policies work. Car insurance is essentially a contract between you and your insurance provider that protects you financially if you’re involved in a car accident or your vehicle is damaged or stolen.

A typical car insurance policy includes several different types of coverage:

- Liability Insurance: This is the most basic and legally required type of insurance in most states. It covers injuries and damages you cause to others in an accident.

- Collision Coverage: This insurance covers the costs of repairing your car if it’s involved in an accident, regardless of who is at fault.

- Comprehensive Coverage: This covers damage to your car from non-collision incidents such as vandalism, theft, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This covers you if you’re involved in an accident with a driver who doesn’t have sufficient insurance or isn’t insured at all.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers if you’re involved in an accident, regardless of who is at fault.

Depending on your state’s insurance laws and the type of coverage you need, car insurance premiums can fluctuate significantly.

The Factors That Determine Your Car Insurance Premium

When looking for cheap car insurance, understanding the factors that affect the price is critical. Car insurance companies take a wide range of variables into account when setting your rates, and being aware of them can help you make smarter decisions about your insurance policy.

1. Your Driving Record

One of the most significant factors in determining your car insurance rates is your driving history. Insurance companies reward drivers who have clean records with lower premiums. If you’ve had a history of accidents or traffic violations, your rates are likely to be higher.

Insurers see drivers with good records as lower risk, and they offer lower rates to entice them. On the other hand, drivers with speeding tickets, DUIs, or accidents on their record may be classified as higher risk, which results in higher premiums.

2. Age and Gender

Age plays a crucial role in car insurance pricing. Teen drivers, especially males, are statistically the most likely to be involved in accidents, leading to significantly higher insurance premiums. As drivers get older and gain more experience, their premiums usually decrease. For example, young drivers under the age of 25 are often charged much higher rates than older drivers.

Gender also affects car insurance premiums. Young male drivers, in particular, tend to have higher accident rates than their female counterparts, so male drivers are often quoted higher premiums than females. However, once you reach a certain age, gender may not have as significant an effect on your rates.

3. Location

Where you live plays a major role in the cost of car insurance. Urban areas with high traffic or crime rates often result in higher premiums compared to rural areas. Similarly, if you live in a state with stricter insurance laws, you may pay more for your policy.

For example, if you live in a densely populated city like New York or Los Angeles, your rates will likely be higher than if you lived in a small town. Urban areas often have more accidents and vehicle theft, leading to increased insurance costs.

4. The Type of Car You Drive

The make, model, and age of your vehicle will also influence the cost of your insurance. Luxury cars, sports cars, and high-performance vehicles typically carry higher insurance rates due to the cost of repairs and the risk of theft.

On the other hand, smaller, more economical cars tend to cost less to insure, as they are generally less expensive to repair or replace. If you’re looking for cheap car insurance, consider opting for a vehicle that has lower repair costs and fewer safety features that increase the value of the vehicle.

5. Your Credit Score

While not all states use your credit score in determining your insurance rates, many do. Insurance companies often believe that people with lower credit scores are more likely to file claims, so they charge them higher rates. If you have a poor credit score, your insurance premiums could be significantly higher than if you had a better score.

To ensure that you’re getting the best rates possible, work on improving your credit score. Paying bills on time, reducing outstanding debt, and checking your credit report for errors can all help boost your credit score and lower your premiums.

6. Coverage Type and Limits

The more extensive your coverage, the higher your premium. While liability insurance is mandatory, additional coverage types like collision, comprehensive, and uninsured motorist protection can raise your premium.

When searching for cheap car insurance, it’s crucial to find a balance between adequate coverage and affordability. If you’re insuring an older vehicle with a low market value, it might make sense to drop some optional coverages like comprehensive or collision insurance to save money.

How to Find the Cheapest Car Insurance in the USA

Now that we’ve covered what factors influence the cost of car insurance, let’s take a look at some strategies for finding cheap car insurance in the USA.

1. Compare Multiple Quotes

The easiest way to find cheap car insurance is to shop around. Don’t settle for the first quote you get. Use comparison websites to get quotes from different insurance companies, and compare them side-by-side. Often, prices can vary by hundreds of dollars, so taking the time to compare can result in significant savings.

Be sure to look at the details of each policy to ensure you’re comparing apples to apples. Some providers may offer similar rates but differ in the types of coverage, exclusions, and deductibles. So, take your time and find the policy that fits your needs and budget.

2. Consider Raising Your Deductible

One way to lower your premium is to increase your deductible—the amount you pay out of pocket before your insurance kicks in. A higher deductible typically results in a lower monthly premium, but be sure to choose a deductible that you can afford to pay if you ever need to make a claim.

If you choose to raise your deductible, make sure you have enough savings set aside to cover the deductible in the event of an accident. If not, you might find yourself struggling financially after an incident.

3. Bundle Your Insurance Policies

If you already have other insurance policies, such as homeowners or renters insurance, consider bundling them with your car insurance. Many insurers offer discounts for customers who purchase multiple types of insurance from them, which can help lower your overall costs.

Not only can bundling policies save you money, but it also makes managing your insurance simpler. You’ll only need to work with one company, and you may even receive additional perks such as customer service discounts.

4. Take Advantage of Discounts

Most car insurance companies offer various discounts to help lower your premium. These discounts can vary based on your driving habits, vehicle, and even where you live. For instance, some insurers offer discounts for safe driving, having anti-theft devices in your car, or maintaining a good credit score.

Here are a few discounts you may be eligible for:

- Good driver discount

- Multi-car discount

- Low mileage discount

- Anti-theft device discount

- Student driver discount

Additionally, some insurers offer loyalty discounts if you’ve been with them for several years, or discounts for being a member of certain professional organizations. Always ask your insurer what discounts they offer to ensure you’re getting the best rate possible.

5. Review Your Coverage Regularly

Your insurance needs may change over time, so it’s important to review your policy regularly. If you’ve paid off your car or it’s become less valuable, you might consider dropping certain coverages like comprehensive or collision. This could save you money without sacrificing essential protection.

You should also review your policy if you make significant changes in your life, such as moving to a new location or purchasing a new vehicle. Keeping your insurance up-to-date ensures that you’re not paying for coverage you don’t need.

The Most Common Mistakes to Avoid When Shopping for Cheap Car Insurance

While looking for cheap car insurance, it’s easy to get caught up in the desire to save money. However, there are several mistakes that can end up costing you more in the long run. Here are some common pitfalls to avoid:

1. Underestimating Coverage Needs

While you may be focused on finding cheap car insurance, don’t forget to consider how much coverage you truly need. The cheapest option may not always provide the necessary protection if you’re involved in a serious accident.

Be sure to assess your needs based on your vehicle, location, and driving habits. While state minimums may seem sufficient, they might leave you with significant out-of-pocket expenses in the event of a serious incident.

2. Focusing Solely on Price

Price is important, but it shouldn’t be the only factor in your decision. Choosing the lowest-priced policy without understanding what’s covered can lead to out-of-pocket expenses if you’re ever in an accident.

Always read the policy details carefully and make sure you fully understand the exclusions, limits, and deductibles. A cheaper policy may not provide adequate protection, leaving you financially exposed.

3. Failing to Update Your Policy

As life changes, so do your insurance needs. For example, if you’ve added a new driver to your household or purchased a new car, make sure your policy reflects these changes. Failing to update your policy could result in insufficient coverage or higher premiums.

Regularly reviewing your policy helps ensure that you’re only paying for coverage that matches your current circumstances. Be proactive about updating your policy to avoid any surprises.

Finding the Best Cheap Car Insurance in the USA

Finding affordable car insurance in the USA is about more than just looking for the lowest price. By considering the factors that affect your rates, comparing quotes, taking advantage of discounts, and adjusting your coverage to suit your needs, you can secure cheap car insurance without sacrificing protection.

While it may take a bit of effort and research, the savings you can achieve by finding the right policy are well worth it. Remember, your car insurance should be a balance of affordability and adequate coverage to keep you protected on the road.

By following the tips in this guide and utilizing the right strategies, you can find cheap car insurance that suits your needs and your budget.