Understanding the intricacies of an insurance policy can be daunting for anyone stepping into the world of risk management for the first time. Insurance policies are laden with specialized terminology, complex clauses, and layered coverage details that often leave policyholders feeling overwhelmed. Yet, mastering the fundamentals of your insurance policy is crucial to safeguarding your financial well-being. When you’re equipped with the knowledge to interpret policy terms, recognize coverage limits, and identify potential pitfalls such as exclusions and conditions, you empower yourself to make informed choices that align with your unique needs.

This guide delves deep into every facet of insurance policies—from the core components and key terminology to advanced strategies for optimizing coverage and managing claims. Whether you’re exploring auto, home, health, or life insurance, the principles shared here will help you navigate your policy with confidence and clarity.

The Foundation of Insurance Policies

Defining an Insurance Policy

An insurance policy is fundamentally a contract between a policyholder and an insurance company. In exchange for regular premium payments, the insurer promises to compensate the policyholder—or a designated beneficiary—for losses incurred from specified risks. These risks, referred to as “perils,” might include property damage, bodily injury, liability claims, or death. Insurance operates on the principle of risk pooling: a large group of policyholders contributes premiums to a collective fund, and losses incurred by a few are absorbed by the pooled resources. This system ensures that no single individual bears the full financial burden of an unexpected event, providing peace of mind and financial stability.

Purpose and Importance of Coverage

Insurance exists to protect policyholders against uncertainties that could otherwise result in devastating financial loss. Without insurance, events such as a major car accident, a catastrophic house fire, or an unexpected medical emergency could wipe out savings, derail long-term financial goals, or force difficult personal decisions. By paying a relatively modest premium, individuals secure a safeguard that can cover repair costs, medical bills, legal liabilities, and even income replacement in certain scenarios. In effect, insurance transforms unpredictable, high-cost events into manageable, budgeted expenses.

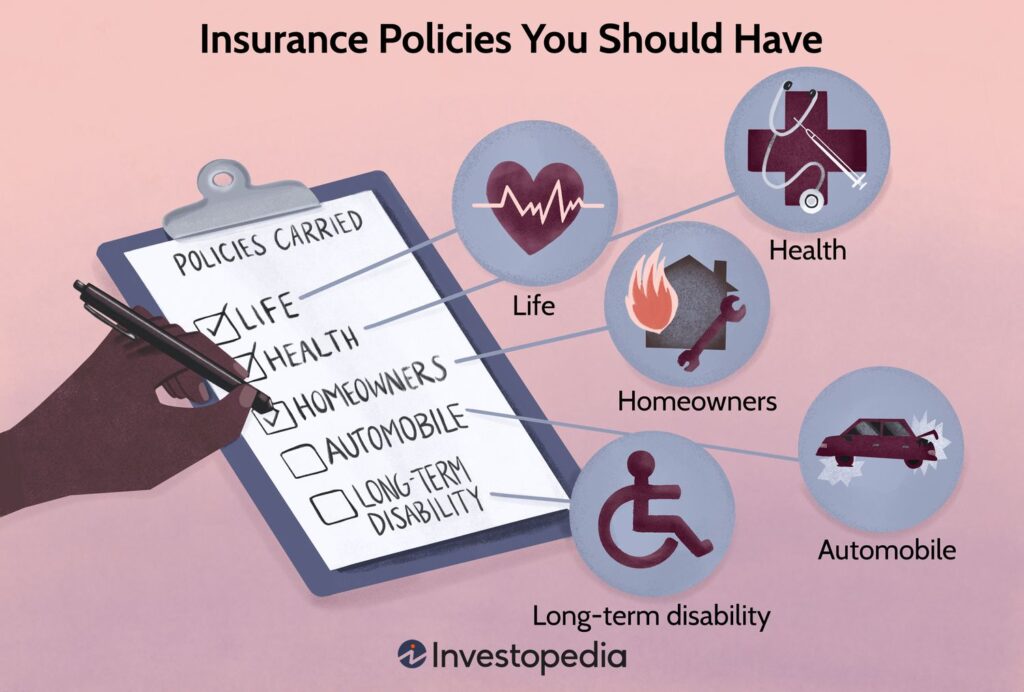

Types of Insurance Policies

Insurance policies come in numerous forms, each tailored to address distinct risks:

- Auto Insurance protects against vehicle-related damage and liability.

- Homeowners Insurance covers structural damage, personal belongings, liability for accidents on your property, and additional living expenses if your home becomes uninhabitable.

- Health Insurance mitigates the cost of medical treatments, hospital stays, prescription drugs, and preventive care.

- Life Insurance offers financial support to beneficiaries upon the policyholder’s death.

- Renters Insurance insures personal property within a rented dwelling and provides liability coverage.

- Disability Insurance replaces a portion of income if the policyholder becomes unable to work due to injury or illness.

- Commercial Insurance encompasses a variety of coverages—such as general liability, property, and professional liability—for businesses.

Each policy type contains unique features and considerations, but all share the same structural components: declarations, insuring agreements, exclusions, conditions, endorsements, and definitions.

Breaking Down Policy Sections

The Declarations Page: Your Policy at a Glance

The declarations page sits at the beginning of every policy, summarizing the most critical information:

- Policyholder details (name, address, contact information)

- Policy number and effective/expiration dates

- Covered property or individuals

- Coverage limits and sub-limits

- Deductibles and premium amounts

When comparing policies or verifying your coverage, the declarations page is your starting point. It provides the quick-reference snapshot to ensure the policy aligns with your requirements.

Insuring Agreement: The Insurer’s Promise

Following the declarations page, the insuring agreement articulates the insurer’s commitment to cover specified perils. It lists the covered events—such as fire, theft, collision, or illness—and sets forth the basic scope of protection. Essentially, if a loss results from a peril named in the insuring agreement, and you comply with all conditions and exclusions, the insurer agrees to provide financial compensation up to the policy limits.

Exclusions: What Is Not Covered

Although the insuring agreement outlines covered perils, the exclusions section carves out exceptions. Exclusions might apply to certain high-risk activities (e.g., off-road racing in auto policies), intentional acts, wear-and-tear, or types of damage (e.g., flood, earthquake, mold). Exclusions are critical because they define the policy’s boundaries; understanding them helps you identify gaps that may require separate coverage or endorsements.

Conditions: Your Obligations

Conditions specify obligations that both the policyholder and the insurer must meet. Common conditions include:

- Notifying the insurer promptly after a loss

- Cooperating with investigations, including providing statements and documentation

- Preventing further damage (e.g., boarding up windows after a break-in)

- Filing a proof of loss, typically in writing

Failure to adhere to these conditions can result in claim denial. Thus, reading and understanding the conditions section before a loss occurs is as important as knowing your coverage.

Endorsements and Riders: Tailoring Your Policy

Endorsements—often called riders—customize a standard policy by adding, removing, or modifying coverage. Examples include:

- Jewelry and valuable items endorsement on homeowners policies

- Rental reimbursement endorsement on auto policies

- Waiver of premium rider on life insurance

Endorsements allow you to fine-tune your coverage, ensuring unique assets or exposures are adequately protected. Always review the premium impact of adding or removing endorsements to maintain a balance between cost and protection.

Definitions: Decoding Insurance Jargon

Policies conclude with a definitions section that clarifies the precise meaning of terms used throughout. Words like “occurrence,” “insured,” “bodily injury,” and “property damage” may have specific legal definitions that differ from everyday usage. Paying close attention to definitions ensures you interpret coverage accurately and avoid misunderstandings.

Mastering Key Policy Terms

Premiums, Deductibles, and Out-of-Pocket Costs

- Premium: The periodic payment you make to keep the policy active. Premiums are influenced by factors such as your risk profile, coverage limits, location, and policy type.

- Deductible: The amount you pay out of pocket before the insurer pays on a claim. Higher deductibles generally lower your premium but increase your initial expense at claim time.

- Coinsurance: Common in health and property insurance, coinsurance requires the policyholder to cover a percentage of the loss after the deductible. For instance, an 80/20 coinsurance clause means the insurer pays 80 percent of the amount after the deductible, and you pay 20 percent.

Balancing premium affordability with deductible manageability is crucial. A deductible you cannot afford during an emergency undermines the value of your insurance.

Policy Limits: The Maximum Payout

Policy limits cap the insurer’s payout. They can be stated as:

- Per-occurrence limits: Maximum amount paid for each separate claim.

- Aggregate limits: Maximum total payout during the policy term.

For liability coverage, you may encounter split limits (e.g., “$100,000/$300,000”), indicating per-person and per-accident caps. Ensuring your limits align with potential exposure is particularly important for auto and liability policies, where legal judgments can exceed basic limits.

Subrogation and Salvage

- Subrogation: After paying your claim, your insurer may pursue the at-fault third party to recover expenses. Subrogation keeps insurance costs down by ensuring responsible parties ultimately bear the loss.

- Salvage: Refers to property—often a vehicle—that retains value even after significant damage. In total-loss scenarios, insurers calculate the salvage value and deduct it from the payout.

Understanding these mechanisms clarifies post-claim procedures and potential reimbursements.

Cancellation, Non-Renewal, and Grace Periods

Insurers typically include clauses detailing when and how they can cancel or non-renew a policy, as well as the policyholder’s rights in such events. They also define grace periods—a timeframe after a missed premium during which coverage remains active. Knowing these provisions protects you from unexpected coverage lapses.

Deep Dive into Coverage Types

Auto Insurance Coverage

Auto policies generally comprise:

- Liability Coverage for bodily injury and property damage you cause to others.

- Collision Coverage for damage to your vehicle from accidents.

- Comprehensive Coverage for non-collision losses (theft, fire, natural disasters, vandalism).

- Personal Injury Protection (PIP) or Medical Payments for medical expenses.

- Uninsured/Underinsured Motorist Coverage for accidents involving drivers lacking adequate insurance.

Each component carries its own limits and deductibles. State regulations often mandate minimum liability limits, but raising these limits protects you from lawsuits exceeding basic requirements.

Homeowners and Renters Insurance

Homeowners insurance typically includes:

- Dwelling Coverage for structural damage to your home.

- Other Structures for detached garages or fences.

- Personal Property to replace belongings.

- Liability Coverage for third-party injuries.

- Loss of Use for additional living expenses if your home becomes uninhabitable.

Renters insurance omits dwelling coverage but provides personal property, liability, and additional living expense coverage. Important distinctions include replacement cost versus actual cash value valuations and off-premises coverage for belongings taken outside your residence.

Health Insurance Essentials

Health policies specify covered services, provider networks, cost-sharing mechanisms (deductibles, copayments, coinsurance), and out-of-pocket maximums. Key considerations:

- In-Network vs. Out-of-Network benefits and reimbursement rates.

- Formulary Tiers for prescription medications.

- Preventive Care coverage mandated by law.

Glossaries provided by state insurance departments and associations—such as the National Association of Insurance Commissioners (NAIC)—can help demystify health insurance terminology .

Life Insurance Variations

Life insurance falls into two broad categories:

- Term Life Insurance, which offers coverage for a specified period (e.g., 10, 20, 30 years).

- Permanent Life Insurance, including whole life and universal life, providing lifetime coverage and cash value accumulation.

Additional features—such as accelerated death benefits, paid-up additions, and policy loans—vary by product. Evaluating life insurance requires balancing death benefit size, premium stability, and cash value growth potential.

Selecting the Right Policy

Assessing Your Risk Profile

Before purchasing insurance, conduct a thorough self-assessment:

- Inventory assets and their replacement costs.

- Evaluate liability exposures based on your lifestyle and profession.

- Consider geographic risks, such as flood zones or high-crime areas.

- Review your health history and family medical trends.

A risk profile informs the coverage types and limits you need, ensuring you don’t overpay for unnecessary protections or underinsure critical assets.

Comparing Quotes and Insurers

Utilize reputable comparison websites to gather multiple quotes simultaneously. When comparing:

- Match coverage types, limits, and deductibles across quotes.

- Investigate insurer financial strength ratings from agencies like A.M. Best, Standard & Poor’s, and Moody’s.

- Research customer satisfaction and claims handling metrics through organizations such as J.D. Power and the Better Business Bureau.

- Inquire about available discounts—multi-policy, safe driver, loyalty rewards, and more.

However, don’t rely solely on online summaries; always request and review full policy documents before binding coverage.

Agent vs. Broker vs. Direct Purchase

- Agents represent one or more insurers and can guide you toward products they offer.

- Brokers work independently and can provide broader market access, searching multiple insurers to find the best fit.

- Direct Purchase through an insurer’s website often yields the lowest premiums but minimal advisory support.

Choosing the appropriate channel depends on your comfort level with risk, familiarity with insurance products, and desire for personalized service.

Managing Your Policy Over Time

Annual Policy Reviews

Life circumstances and market conditions change. To ensure your policy remains aligned with your needs:

- Review at renewal for changes in replacement costs, vehicle values, health care needs, or life events (marriage, new home, new child).

- Update endorsements or limits if you acquire valuable assets or face increased liability exposures.

- Shop competing quotes to verify your insurer remains competitive.

An annual review prevents coverage gaps and unnecessary premium hikes.

Adjusting Coverage for Major Life Events

Significant milestones—such as purchasing a home, expanding a family, changing careers, or starting a business—often necessitate policy adjustments. For example:

- New drivers in the household require adding young adults to auto policies.

- Home renovations can increase replacement costs, calling for higher dwelling coverage.

- Career shifts (e.g., healthcare professional vs. retail employee) may affect liability exposures.

- Business ventures often warrant commercial coverage separate from personal policies.

Proactive communication with your insurer ensures your coverage evolves alongside your life.

Taking Advantage of Discounts and Incentives

Insurers reward risk-mitigating behaviors and policy bundling. Common discounts include:

- Multi-policy (bundling auto and homeowners)

- Safe driving courses and telematics-based usage programs

- Home security systems and fire alarms

- Academic achievement or professional affiliations

Regularly inquire about new discount programs and incentivized offerings to lower your overall cost of protection.

Navigating the Claims Process

First Steps after a Loss

When a covered loss occurs, immediate actions can streamline your claim:

- Ensure safety and prevent further damage (e.g., secure loose boards, turn off utilities).

- Document the scene with photos or videos of damage and circumstances.

- Notify your insurer promptly—most policies require notification within a specified timeframe.

Quick, thorough documentation supports a smoother investigation and accelerates claim resolution.

Working with Adjusters

An insurance adjuster—either staff or an independent contractor—evaluates your claim. Adjusters:

- Inspect damage and compile estimates

- Review policy terms, exclusions, and conditions

- Negotiate settlement amounts within policy limits

Maintain open communication, provide requested documentation promptly, and seek clarification when needed. If disputes arise, you may request a second inspection or involve an appraiser as provided by your policy’s appraisal clause.

Understanding Claim Settlements

Settlements can involve:

- Actual Cash Value (ACV): Replacement cost minus depreciation.

- Replacement Cost Value (RCV): Full cost to repair or replace without depreciation, subject to policy limits.

- Agreed Value: A preset amount agreed upon at policy inception, often used for classic cars or specialty items.

Recognizing the valuation method affects your expected payout and helps set realistic expectations during negotiations.

Appealing Denied Claims

If your claim is denied, review the denial letter for specific reasons—often tied to exclusions, unmet conditions, or covered perils not applying. You can:

- Submit additional documentation or clarification.

- File an internal appeal following your insurer’s dispute process.

- Contact your state’s department of insurance for mediation.

- Engage an attorney or public adjuster if significant sums are involved.

Persistence and thorough documentation often lead to successful resolutions.

Advanced Strategies for Savvy Policyholders

Layered Coverage and Umbrella Policies

An umbrella policy provides excess liability coverage beyond underlying policies’ limits, typically in increments of $1 million. For individuals with high-net-worth, substantial assets, or professions prone to lawsuits, umbrella coverage offers a cost-effective layer of protection, safeguarding savings, investments, and future earnings.

Captive Insurance and Self-Insurance

Businesses and high-net-worth individuals sometimes form captive insurance companies—insurers owned by the insureds—to tailor coverage, retain underwriting profits, and control risk management. Self-insurance, or setting aside funds to cover predictable losses, is another strategy for large corporations and municipalities. Both approaches require sophisticated actuarial analysis and regulatory compliance but can yield long-term cost benefits for entities with specialized risk profiles.

Leveraging Technology and Telematics

Insurers increasingly use telematics devices—installed hardware or mobile apps—to monitor driving behaviors such as speed, braking, and mileage. Safe-driving data can translate into usage-based insurance (UBI) discounts, rewarding policyholders with lower premiums based on actual risk. Similarly, smart home sensors and connected devices can alert homeowners—and insurers—to water leaks, smoke, or security breaches, potentially reducing claims and unlocking premium credits.

Integrating Risk Management and Loss Prevention

Effective risk management involves identifying exposures and implementing preventive measures—such as installing fire suppression systems, conducting regular vehicle maintenance, or investing in cybersecurity protocols for businesses. Insurers often provide risk control services and training to commercial clients, helping mitigate losses and fostering safer environments. Policyholders who proactively address hazards not only reduce claims but also benefit from lower insurance costs over time.

Frequently Asked Questions

How Do I Know if My Coverage Is Adequate?

Assess adequacy by comparing your coverage limits to the replacement value of assets, potential medical costs, and liability exposures. Tools such as online calculators and consultations with insurance advisors can provide data-driven recommendations.

Can I Switch Insurers Mid-Term?

Mid-term cancellations are possible but may incur fees or prorated premium adjustments. Ensure your new policy’s effective date aligns seamlessly with the old policy’s cancellation to avoid gaps in coverage.

What Are Common Pitfalls to Avoid?

Overlooking exclusions, underestimating liability needs, and neglecting to inform insurers of life changes rank among common mistakes. Regular policy reviews and open dialogue with your agent or broker mitigate these risks.

How Can I Lower My Insurance Premium?

Consider raising deductibles, bundling policies, maintaining a clean claims history, completing accredited safety courses, and leveraging available discounts. Shopping for competitive quotes at each renewal also keeps premiums in check.

What Should I Do After a Major Disaster?

Prioritize safety and immediate needs—seek shelter and medical attention. Document all damage comprehensively, preserve damaged property when possible, and contact your insurer without delay. Many insurers deploy catastrophe response teams to assist policyholders in high-impact areas.

Conclusion

Mastering your insurance policy is a multifaceted endeavor that begins with familiarizing yourself with foundational components—declarations, insuring agreements, exclusions, conditions, endorsements, and definitions. By internalizing key terminology such as premiums, deductibles, policy limits, and subrogation, you gain the confidence to select, compare, and customize coverage that aligns with your personal or business risk profile.

Regular policy reviews, proactive risk management, and strategic use of endorsements and layered coverage protect you from life’s uncertainties while optimizing costs. When loss occurs, a well-prepared policyholder knows how to document, file, and negotiate claims effectively, minimizing stress and financial impact. Armed with the insights in this guide, you are poised to navigate the complex landscape of insurance policies, transform jargon into actionable knowledge, and secure the comprehensive protection you deserve.

Source Links (Count: 6)

- Investopedia – Insurance Policy Definition: https://www.investopedia.com/terms/i/insurance-policy.asp

- National Association of Insurance Commissioners – Consumer Glossary: https://content.naic.org/consumer_glossary.htm

- Insurance Information Institute – What Is an Insurance Policy?: https://www.iii.org/article/what-is-an-insurance-policy

- NerdWallet – Understanding Insurance Policies Comparison Guide: https://www.nerdwallet.com/article/insurance/understanding-insurance-policies

- Better Business Bureau – Insurance Company Ratings: https://www.bbb.org/insurance

- J.D. Power – Auto Insurance Satisfaction Ratings: https://www.jdpower.com/business/press-releases/2024-us-auto-insurance-study