Introduction: Understanding Medicare Advantage Plans in 2025

When it comes to healthcare for seniors, the options can be overwhelming. With numerous plans available, it’s critical to have a solid understanding of Medicare and how Medicare Advantage Plans fit into the mix. If you or a loved one is nearing the age of 65 or is currently navigating Medicare, it’s essential to understand the various plan types, benefits, costs, and eligibility criteria to make the best healthcare decision for your needs.

Medicare Advantage Plans are becoming increasingly popular, and for good reason. These plans, also known as Part C, offer a unique combination of health coverage provided by private insurers but regulated by Medicare. They often come with added benefits not covered under traditional Medicare, such as prescription drug coverage, vision, dental care, and wellness programs.

As we approach 2025, the landscape of Medicare Advantage Plans continues to evolve, making it more important than ever to understand how they work and what changes may come. This comprehensive guide will break down everything you need to know about Medicare Advantage Plans, including their benefits, types, costs, and how to choose the right plan.

What Are Medicare Advantage Plans?

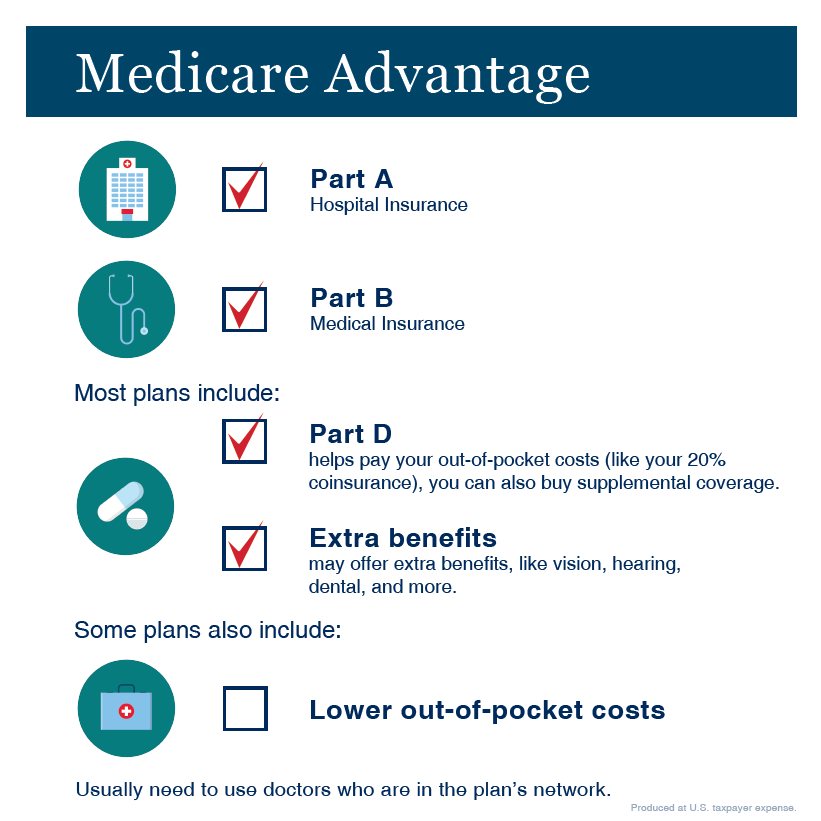

Medicare Advantage Plans (Part C) provide an alternative way to receive your Original Medicare (Part A and Part B) benefits. These plans are offered by private insurance companies approved by Medicare, and they are required to cover at least the same benefits as Original Medicare, except for hospice care, which continues to be covered by Part A.

What makes Medicare Advantage Plans appealing to many seniors is that they often offer extra benefits, such as prescription drug coverage, routine vision and dental care, wellness programs, and hearing services. Many also include coverage for emergency care when traveling outside the U.S., which Original Medicare doesn’t provide.

However, the key difference lies in how the plans work. Original Medicare allows you to choose any doctor or hospital that accepts Medicare, while Medicare Advantage Plans typically work within a network of doctors and hospitals. These network restrictions might not suit everyone, but for many, the added benefits of Medicare Advantage Plans make them worth considering.

The Components of Medicare Advantage Plans

Medicare Advantage Plans are often described as an all-in-one package because they combine several key healthcare components. Here are the essential components of a typical Medicare Advantage Plan:

- Part A – Hospital Insurance: Medicare Part A covers inpatient hospital stays, care in skilled nursing facilities, hospice care, and some home health care services.

- Part B – Medical Insurance: Medicare Part B covers outpatient care, doctor’s services, preventive services, and some other healthcare services that Part A doesn’t cover.

- Additional Benefits: Many Medicare Advantage Plans offer benefits beyond what Original Medicare provides. These can include:

- Prescription Drug Coverage (Part D): A prescription drug plan is typically included, so you don’t need to enroll in a separate Part D plan.

- Vision and Dental: Many plans offer vision and dental coverage, which is not included in Original Medicare. This can be a huge benefit for seniors who need regular eye exams, glasses, or dental care.

- Hearing: Some plans offer hearing exams and hearing aids, which Original Medicare does not cover.

- Wellness Programs: Some Medicare Advantage Plans include memberships to fitness centers or wellness programs aimed at maintaining a healthy lifestyle.

Why Choose a Medicare Advantage Plan in 2025?

The growing popularity of Medicare Advantage Plans in 2025 can be attributed to several key factors. If you’re considering your healthcare options, here’s why you might opt for a Medicare Advantage Plan:

- Comprehensive Coverage: Medicare Advantage Plans provide an all-in-one solution. Unlike Original Medicare, which covers only hospital and medical services, Medicare Advantage plans bundle in additional services such as dental, vision, hearing, and prescription drugs. Having these additional benefits can help cover a broader range of healthcare needs.

- Cost Predictability: Medicare Advantage Plans typically have a cap on your out-of-pocket expenses for covered services. This annual limit helps protect you from high medical costs. Once you reach this limit, the plan pays 100% of your covered healthcare costs.

- Lower Costs for Many Services: Medicare Advantage Plans often offer lower premiums than Original Medicare when combined with a Part D drug plan. They can also have lower copayments and coinsurance for services compared to traditional Medicare, which may help reduce overall costs for seniors.

- Extra Benefits: Many Medicare Advantage Plans include benefits that go beyond the basics, such as coverage for chiropractic care, acupuncture, and transportation to medical appointments. These additional benefits can make life easier and more convenient for seniors.

- Convenience: For many, Medicare Advantage Plans provide convenience by combining medical and prescription drug coverage into a single plan. Additionally, these plans often offer added perks like telehealth services, which have become increasingly important since the COVID-19 pandemic.

Key Considerations When Choosing a Medicare Advantage Plan

While the benefits of Medicare Advantage Plans are undeniable, there are key factors to consider before enrolling. Making the wrong choice can result in unexpected out-of-pocket costs or limited access to healthcare providers. Here are the main factors to consider when choosing a plan:

- Network Restrictions: Most Medicare Advantage Plans require you to use their network of doctors and hospitals. If you have a preferred doctor or hospital, you need to ensure that they are included in the plan’s network. Some plans may also require referrals to see specialists, which adds another layer of restriction to the process.

- Plan Costs: While Medicare Advantage Plans generally have lower premiums than Original Medicare, they may have additional costs, including copayments, coinsurance, and deductibles. These can vary widely from plan to plan, so it’s important to compare costs carefully.

- Prescription Drug Coverage: Many Medicare Advantage Plans include prescription drug coverage (Part D). If the plan you are considering does not offer Part D coverage, you’ll need to enroll in a separate Part D plan, which could add to your monthly premiums and overall cost.

- Prescription Drug Formulary: If your plan includes prescription drug coverage, be sure to review the plan’s formulary. A formulary is a list of medications that are covered by the plan. It’s essential to check that the medications you take are covered and that they’re included at a reasonable cost.

- Star Ratings: Medicare rates Medicare Advantage Plans on a scale of 1 to 5 stars, with 5 stars being the highest rating. These ratings are based on the plan’s performance, customer satisfaction, and health outcomes. It’s a good idea to choose a plan with a high star rating for better overall care.

Medicare Advantage Plans vs. Original Medicare

When choosing between Medicare Advantage and Original Medicare, it’s important to weigh the pros and cons of each option. Here’s a breakdown of how the two compare:

- Original Medicare: Original Medicare offers the flexibility to see any doctor or specialist who accepts Medicare. This flexibility is a significant advantage for some people. However, Original Medicare does not cover prescription drugs, and it doesn’t provide additional benefits like dental or vision coverage. Additionally, Original Medicare has no out-of-pocket maximum, so there is no limit to what you may have to pay for services.

- Medicare Advantage: While Medicare Advantage Plans generally come with fewer provider options (due to network restrictions), they often offer additional coverage for prescription drugs, dental, vision, hearing, and even wellness services. They also have an out-of-pocket maximum, providing a financial safety net if you experience high medical costs. However, you may need to get a referral for specialists and stay within your plan’s network of providers.

Types of Medicare Advantage Plans

There are several types of Medicare Advantage Plans, each with different features. Understanding the different plan types will help you choose the best one for your needs. Below are the most common types:

- Health Maintenance Organization (HMO) Plans: HMO plans require members to choose a primary care doctor and get referrals for specialists. These plans often have lower premiums and out-of-pocket costs but offer less flexibility when it comes to choosing healthcare providers.

- Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility than HMO plans. You can see any doctor who accepts the plan, without needing a referral. However, PPO plans tend to have higher premiums and out-of-pocket costs than HMO plans.

- Private Fee-for-Service (PFFS) Plans: PFFS plans allow you to see any doctor or healthcare provider that accepts the plan’s payment terms. These plans provide more flexibility but may have higher costs.

- Special Needs Plans (SNPs): SNPs are designed for people with specific health conditions or needs, such as those who are dually eligible for Medicare and Medicaid, or those with certain chronic conditions. These plans provide more focused care and resources tailored to specific health needs.

What’s New in Medicare Advantage Plans for 2025?

As we head into 2025, several key changes are expected in the world of Medicare Advantage:

- Expanded Coverage: Many Medicare Advantage Plans are expanding their coverage to include new benefits such as home health services, over-the-counter medications, and telehealth consultations.

- More Focus on Preventive Care: There is a growing emphasis on preventive care in Medicare Advantage Plans, with more plans offering incentives for staying healthy, such as discounts for gym memberships or rewards for completing preventive screenings.

- Increased Telehealth Access: Since the pandemic, telehealth has become a crucial aspect of healthcare. In 2025, expect more Medicare Advantage Plans to offer expanded telehealth benefits, allowing you to receive medical care from home.

- Lower Out-of-Pocket Costs: To make healthcare more affordable, many plans are lowering their out-of-pocket costs. This can help make Medicare Advantage Plans more appealing to seniors who worry about high medical expenses.

How to Enroll in a Medicare Advantage Plan

Enrolling in a Medicare Advantage Plan is simple, but timing is essential. You can sign up during specific enrollment periods:

- Initial Enrollment Period (IEP): This is the period when you first become eligible for Medicare, typically when you turn 65.

- Annual Enrollment Period (AEP): This period occurs each fall (October 15 to December 7) when you can switch between Medicare Advantage Plans, add or drop prescription drug coverage, or return to Original Medicare.

- Special Enrollment Periods (SEPs): Special circumstances, like moving to a new area or losing other health coverage, may qualify you for an SEP, allowing you to make changes outside of the standard enrollment periods.

Conclusion

Medicare Advantage Plans offer a robust and flexible way for seniors to receive healthcare coverage. These plans provide more than just the basics of Medicare, with additional benefits like dental, vision, and wellness programs. As we move into 2025, the options for Medicare Advantage Plans will continue to expand, making it an even more attractive option for many beneficiaries.

By understanding the components, benefits, and costs associated with these plans, you can make an informed decision that aligns with your health needs and budget. Whether you’re new to Medicare or reevaluating your current plan, this guide should provide the necessary information to navigate the world of Medicare Advantage Plans and ensure you receive the best possible coverage for your healthcare needs.