As we move into 2025, investors are navigating a rapidly evolving financial landscape. The economic environment has shifted significantly in recent years, and with it, a host of new opportunities and challenges have emerged. For those looking to grow their wealth, understanding the key trends and adapting investment strategies will be critical for success. This blog post explores the most important financial trends for 2025, how investors can take advantage of emerging opportunities, and the crucial role of effective portfolio management.

1. The Rise of Sustainable and Impact Investing

The growing awareness of climate change, environmental sustainability, and social responsibility is reshaping the investment world. In 2025, more investors are turning toward sustainable and impact investing, focusing on companies and funds that align with their values.

The Importance of ESG Investments

Environmental, Social, and Governance (ESG) investing has seen massive growth, with more investors considering the long-term impact of their portfolios. By investing in companies with strong ESG practices, investors can not only contribute to a more sustainable future but also potentially earn solid returns. Portfolio management in this area requires careful research and analysis to identify companies that are positioned for growth while promoting social and environmental responsibility.

Incorporating ESG into Portfolio Management

To effectively integrate ESG into portfolio management, investors need to assess individual companies’ ESG scores and the performance of green bonds and other sustainable investment products. The key here is diversification—balancing your portfolio to manage risk while maximizing returns from ESG investments.

2. Embracing Technology in Investment Strategies

The financial sector is increasingly relying on technology to offer innovative solutions to investors. In 2025, advancements in artificial intelligence (AI), blockchain, and fintech are dramatically reshaping the way investors manage their portfolios.

AI and Data Analytics: The Future of Portfolio Management

AI-powered tools are now essential for portfolio management, allowing investors to make data-driven decisions. Machine learning algorithms can analyze vast amounts of data in real time, identifying trends, risk factors, and emerging opportunities that human analysts may miss. For portfolio managers, integrating these tools into their strategies is becoming a necessity to stay ahead in the game.

Blockchain and Digital Assets: The New Frontier

Blockchain technology is also gaining traction, especially in the world of digital currencies and decentralized finance (DeFi). Cryptocurrencies and blockchain-based assets are now being considered by some investors as part of a diversified portfolio, offering new avenues for growth. However, these assets come with higher volatility, so portfolio managers must exercise caution and ensure proper risk management when including these in their clients’ investments.

3. Navigating Global Economic Uncertainty

The world economy has experienced significant turbulence in recent years, with geopolitical tensions, inflationary pressures, and supply chain disruptions affecting global markets. As we approach 2025, these uncertainties are expected to persist, posing both risks and opportunities for investors.

Managing Inflation and Interest Rates

Inflation remains a primary concern for many investors. In response, central banks worldwide are adjusting interest rates to control inflation, which can influence asset prices. In a rising interest rate environment, traditional bonds may underperform, making it important for investors to reassess their fixed-income holdings. Effective portfolio management will require diversification and a strategic mix of assets that can weather these fluctuations.

Geopolitical Risks and Global Diversification

With ongoing geopolitical tensions, including trade wars, political instability, and shifts in global power dynamics, diversifying investments across different countries and regions is essential for mitigating risks. A well-diversified portfolio can help protect against the adverse effects of geopolitical events and offer access to emerging markets that may provide significant growth opportunities.

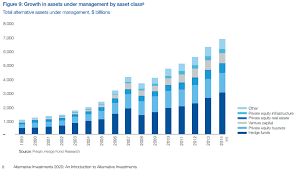

4. The Growth of Alternative Investments

Alternative investments, including private equity, hedge funds, real estate, and commodities, are becoming an increasingly important part of investors’ portfolios in 2025. These assets provide opportunities for higher returns while diversifying risk outside traditional stocks and bonds.

Private Equity and Venture Capital

Private equity and venture capital are becoming increasingly popular as investors seek higher returns. These investments allow individuals to access early-stage startups and high-growth companies that aren’t available in public markets. However, these investments require a more hands-on approach and a deep understanding of the underlying industries. Portfolio management strategies should be tailored to accommodate these high-risk, high-reward assets.

Real Estate and Commodities: A Hedge Against Inflation

Real estate and commodities, particularly precious metals like gold and silver, are often seen as safe havens in times of inflation. For 2025, real estate investments, especially in commercial and industrial sectors, are expected to offer strong growth prospects. Portfolio managers should consider these assets to hedge against inflation and create long-term wealth.

5. Shifting Consumer Behavior and Its Impact on Investment Trends

Consumer behavior continues to evolve, particularly in the wake of the COVID-19 pandemic. The rise of remote work, e-commerce, and digital services is reshaping industries and creating new opportunities for savvy investors.

Investing in the Digital Economy

The digital economy is thriving, with e-commerce, cloud computing, and online entertainment experiencing unprecedented growth. For investors, this means there are many opportunities in tech stocks, digital platforms, and cloud-based services. However, managing these investments in your portfolio requires understanding the long-term trends and the potential risks of investing in tech-heavy sectors.

Healthcare and Biotechnology: The Post-Pandemic Boom

The healthcare and biotechnology sectors are also seeing increased attention. The pandemic accelerated the development of new medical technologies, vaccines, and treatments. Investors who are able to identify the right companies in these sectors will be positioned for success. Portfolio management should include an understanding of the regulatory landscape and the unique risks associated with healthcare investments.

6. The Importance of Diversification and Risk Management

Effective portfolio management is crucial for navigating the complex financial landscape of 2025. One of the key principles of portfolio management is diversification—spreading investments across different asset classes, sectors, and geographic regions to reduce risk.

Building a Resilient Portfolio for 2025

A resilient portfolio can withstand the volatility and uncertainty that are likely to continue in the years ahead. In 2025, diversification will be more important than ever, with investors needing to balance traditional investments with emerging trends and alternative assets. A mix of equity, bonds, real estate, and digital assets can help mitigate risks and optimize returns.

Risk Tolerance and Long-Term Planning

When building a diversified portfolio, it’s essential to assess your risk tolerance and long-term investment goals. A portfolio that works for one investor may not be suitable for another, depending on their financial situation and personal preferences. Portfolio managers need to tailor investment strategies to the individual needs of their clients, keeping in mind both short-term and long-term objectives.

Conclusion: Preparing for the Future of Finance

As the financial landscape evolves, staying informed about the latest trends and opportunities is critical for any investor. From sustainable investments to technological innovations, the opportunities in 2025 are vast and varied. By focusing on effective portfolio management, diversifying investments, and understanding the risks and rewards of different assets, investors can position themselves for long-term success in the ever-changing financial markets.

The financial world is moving quickly, but with the right strategies and tools, investors can thrive in 2025 and beyond. Stay proactive, be adaptable, and always keep your financial goals at the forefront of your investment decisions.

By using relevant keywords such as “portfolio management” throughout the post, it helps boost SEO and attract potential ad revenue from Google AdSense.